Nov. 2020 - Jan 2021

Team of 6: PM x1, Designer x1, Software Engineer x4

My Role: UI/UX Design

Design Deliverables:

Design: User flows, Lo-fi wireframes, conceptual development to mid-fi screens, refined features for the hi-fi prototype, and interaction design of the high-fi prototype

Research: Conducted interviews

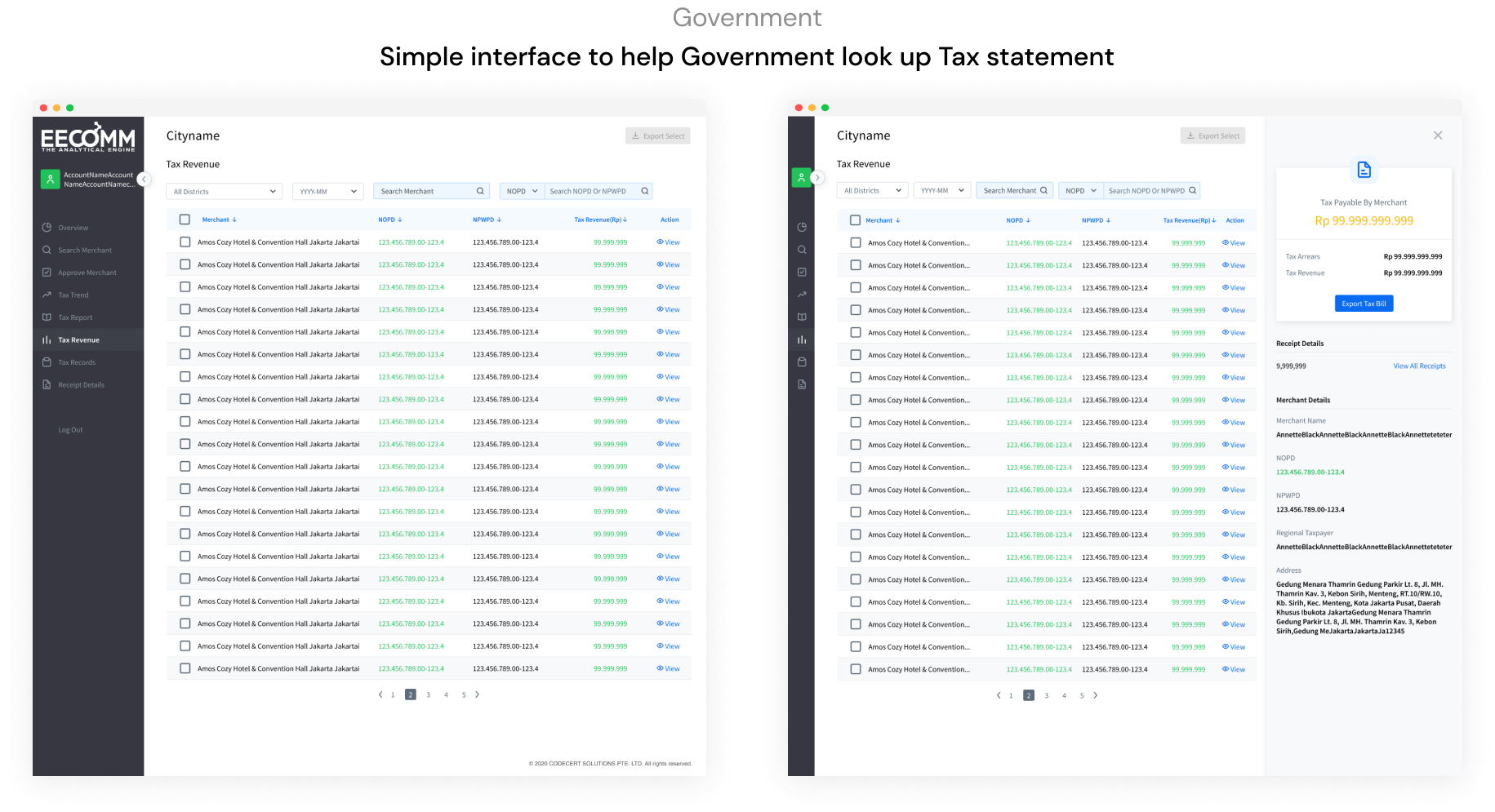

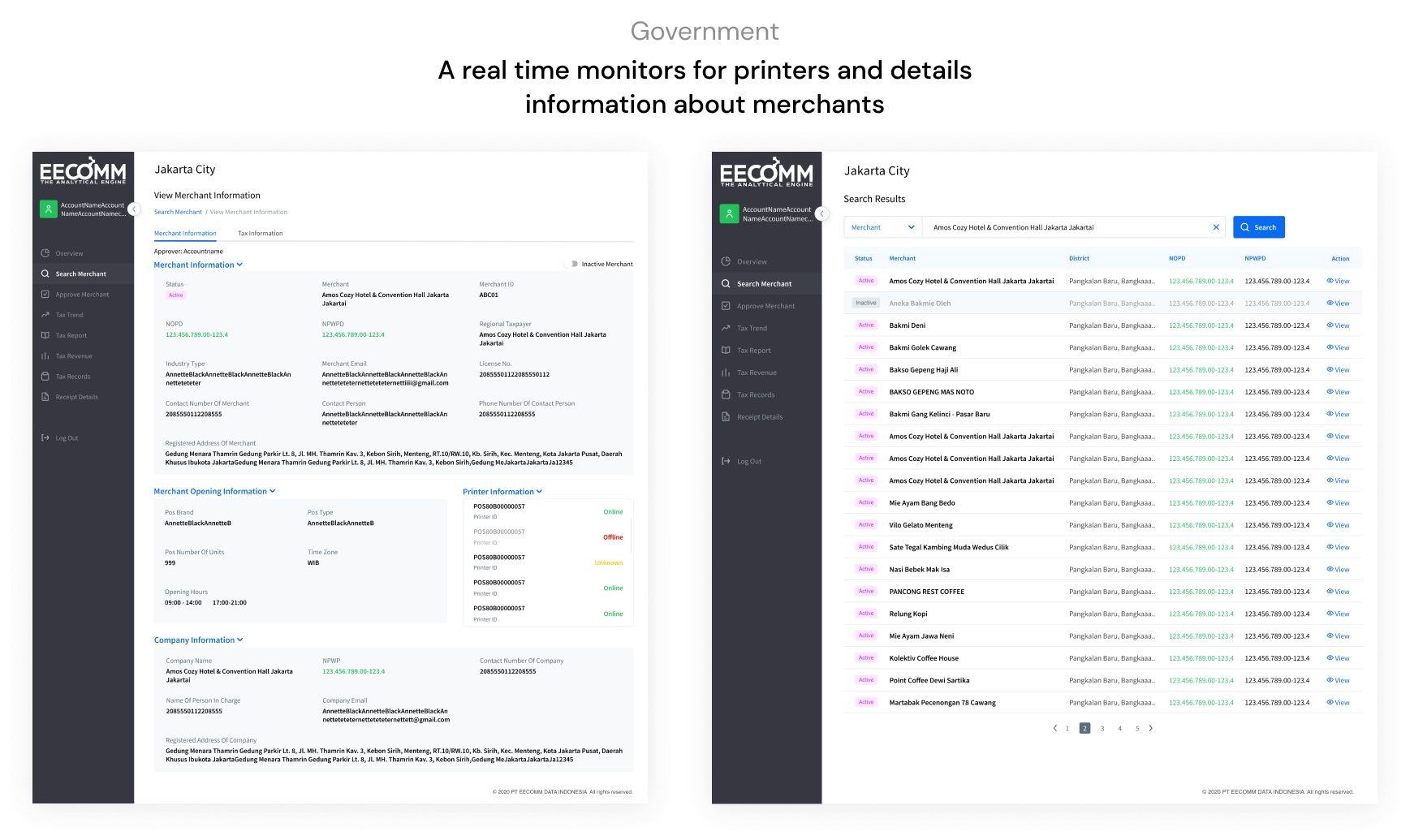

For the government

The Indonesian government is hard to collect taxes for merchants, because lots of merchants evading taxes especially the small business.

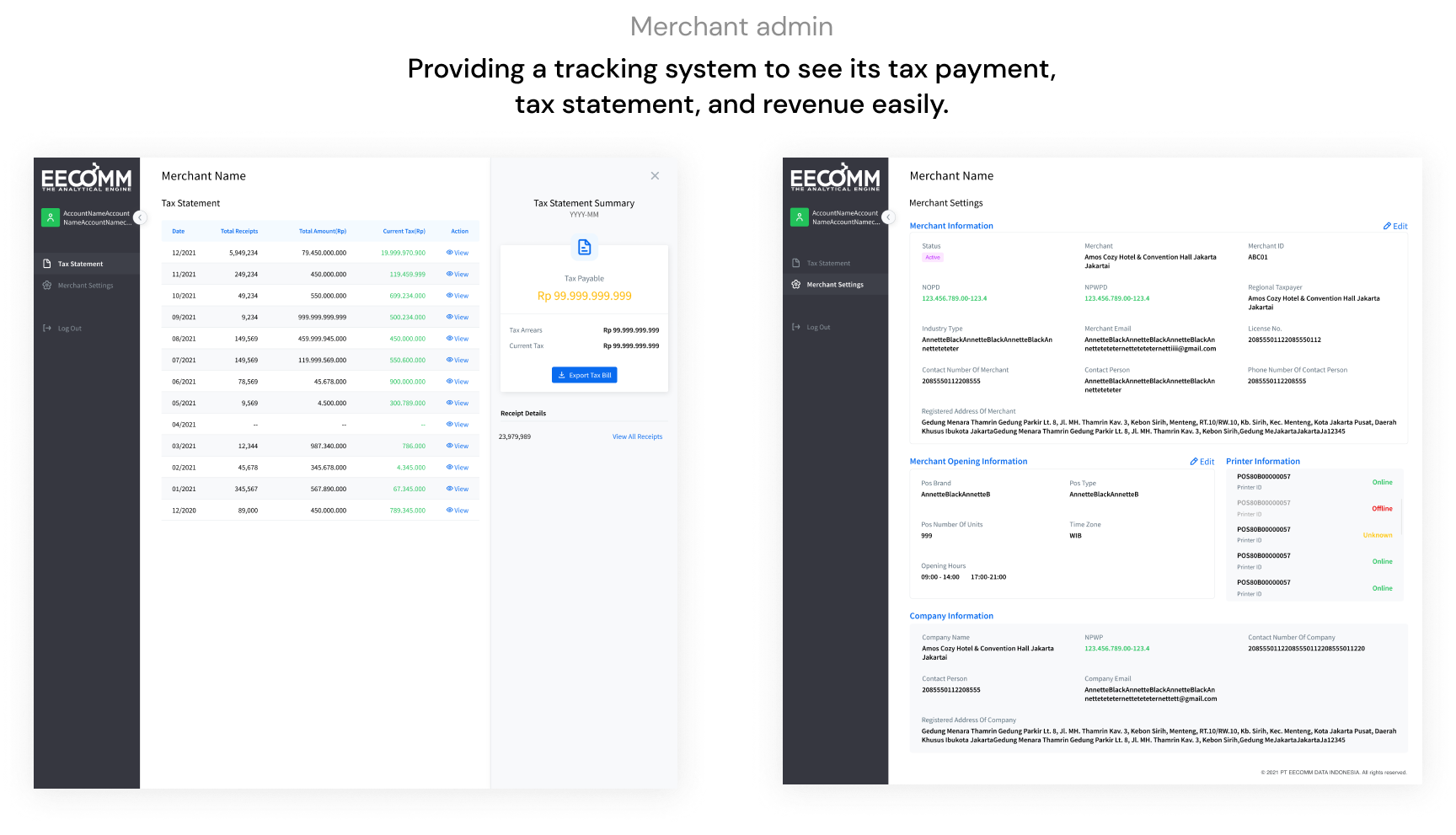

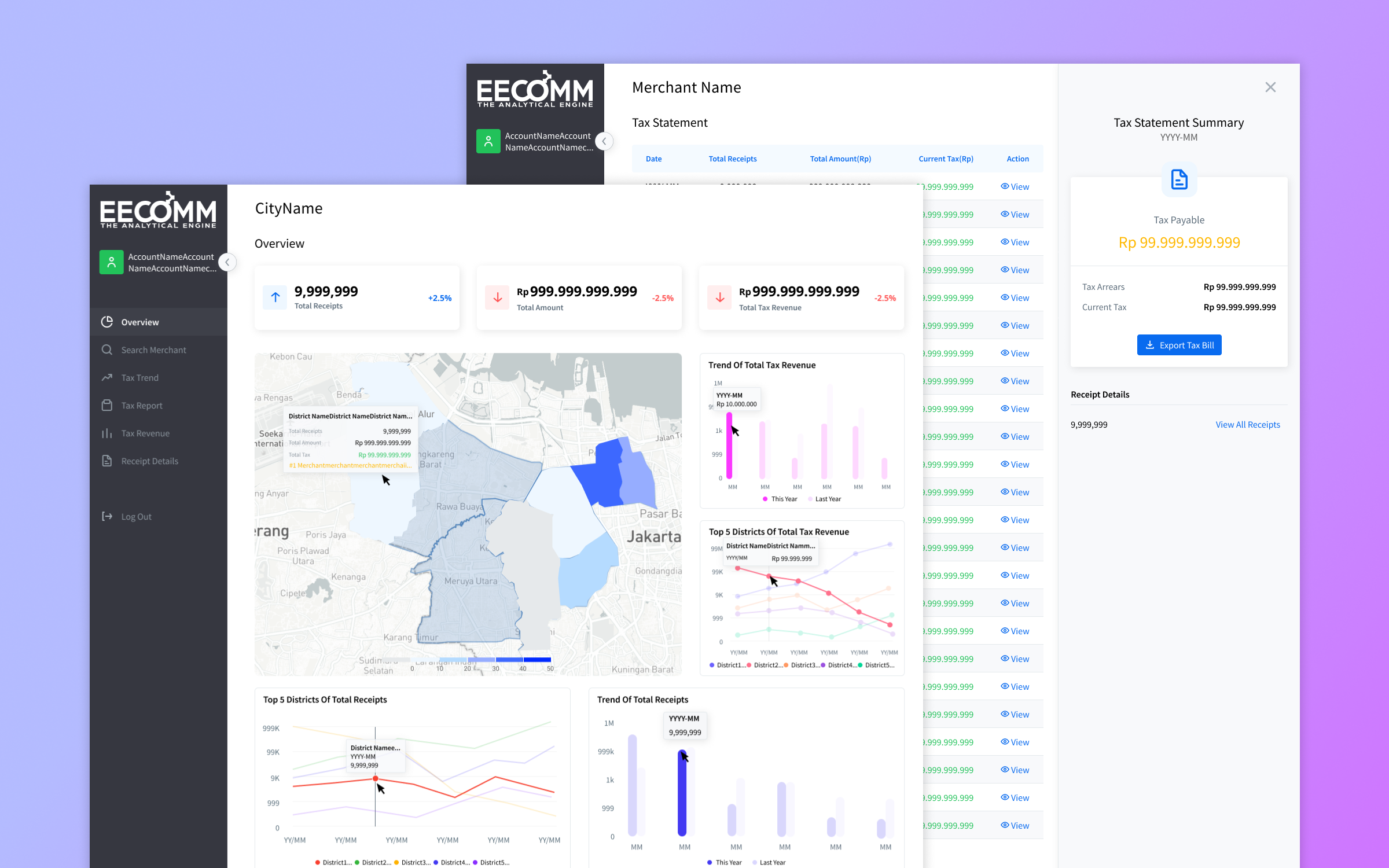

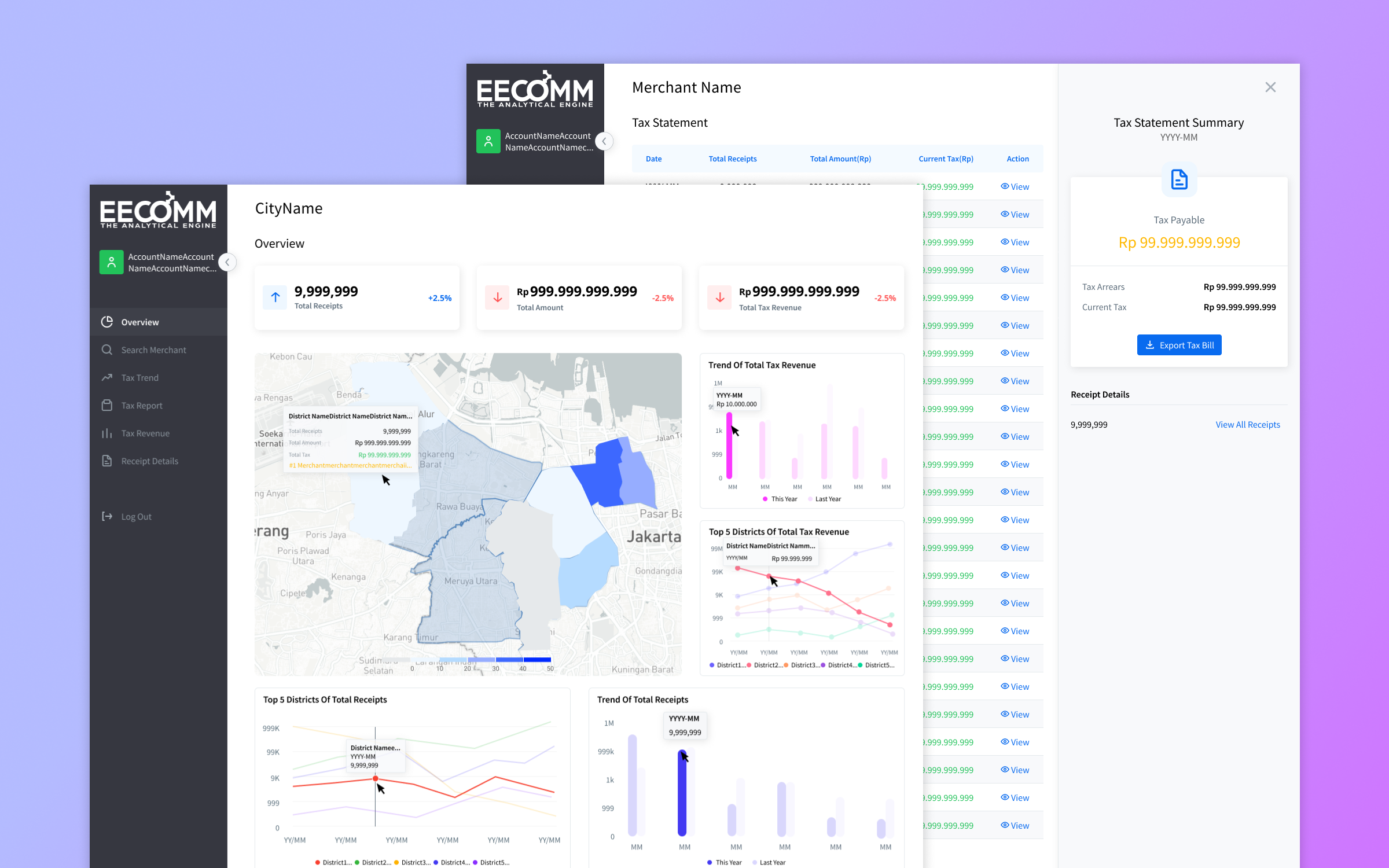

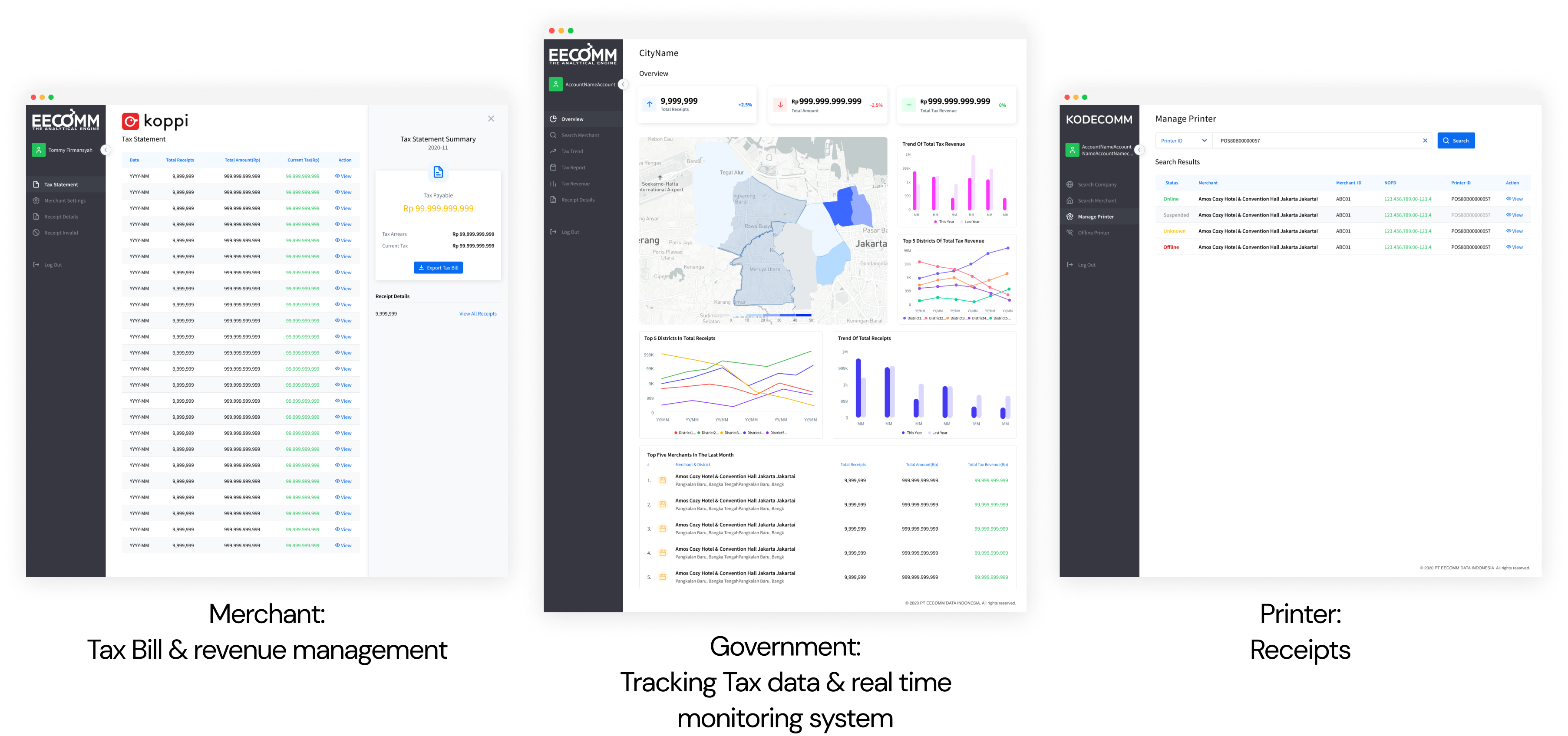

TaxBi is a solution that providing real time monitoring the tax data and tax revenue for goverment and helps merchants be part of taxpayers.

Through TaxBi, merchants can avoid the complicated register process and also pay tax bill easily. The system tracks merchants’ revenue and assist them pay tax bills on time.

Tax Evasion

Our client: One of cities from Indonesia, where is the famous tourist attraction. This local city of government is suffering evading tax from merchants especially from the small merchants. The amount of tax evasion is very impressive.

Government / Merchant /Printer(Receipt)

Government is our main target audience, but at the meantime we also need to serve merchant to pretend them for over charging and also providing the clear data for them. The original PB1 tax system is also complicate, such as how Indonesian government to collect the tax.

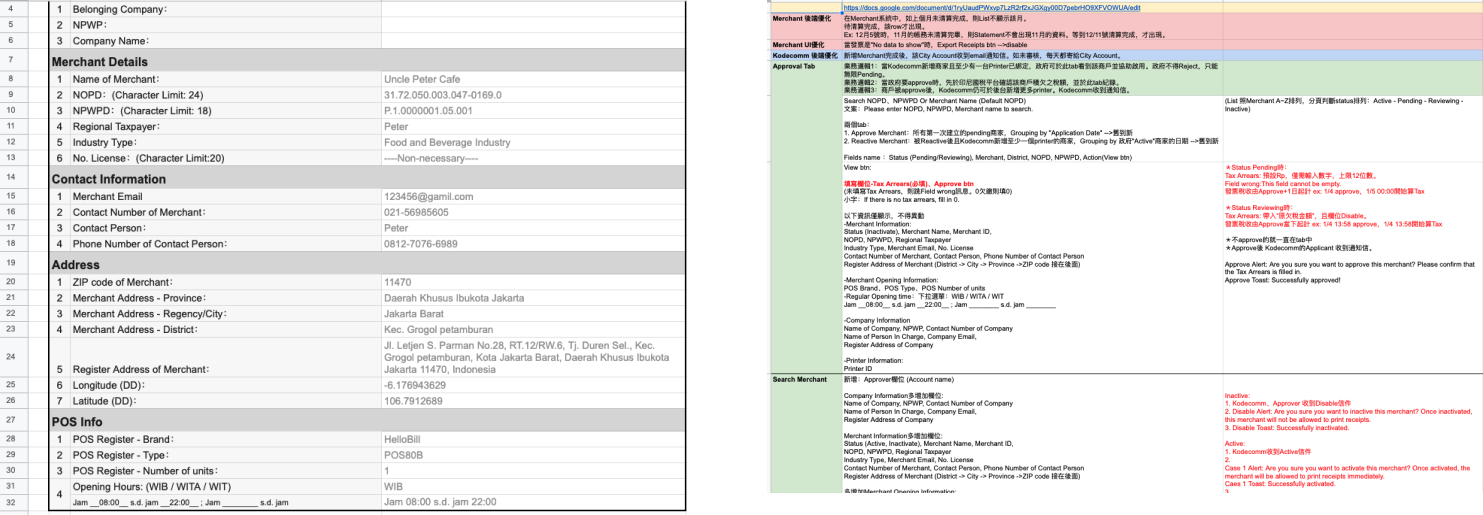

Smooth the applying process when merchant submit their applications.

The project comes from entire zero which needs to build this from head to toe.

User interview(Stakeholder)

Task analysis

In early stage, we haven't have a chance to talk with local business yet. However, we use Taiwanese business model as a reference to design this system as well. In order to provide a picture about workflows of paying sales taxes between merchants and government.

The most significant insight was how manual the workflow was. Governments are constantly switching between different systems to record or look up reference information. There were multiple communication between merchants and government if the submitted information is wrong. With such a fragmented process, people usually passive about applying tax payment.

Merchant needs to complete lots of paper works and submit lots of certificates and license. Especially small business.

Goverment needs to manual to review paper works and it takes lots of time to process whole things.